Enhanced Risk Management

Tools to calculate and forecast key financial metrics like NPV and IRR, allowing developers to identify and mitigate potential financial risks early in the project lifecycle.

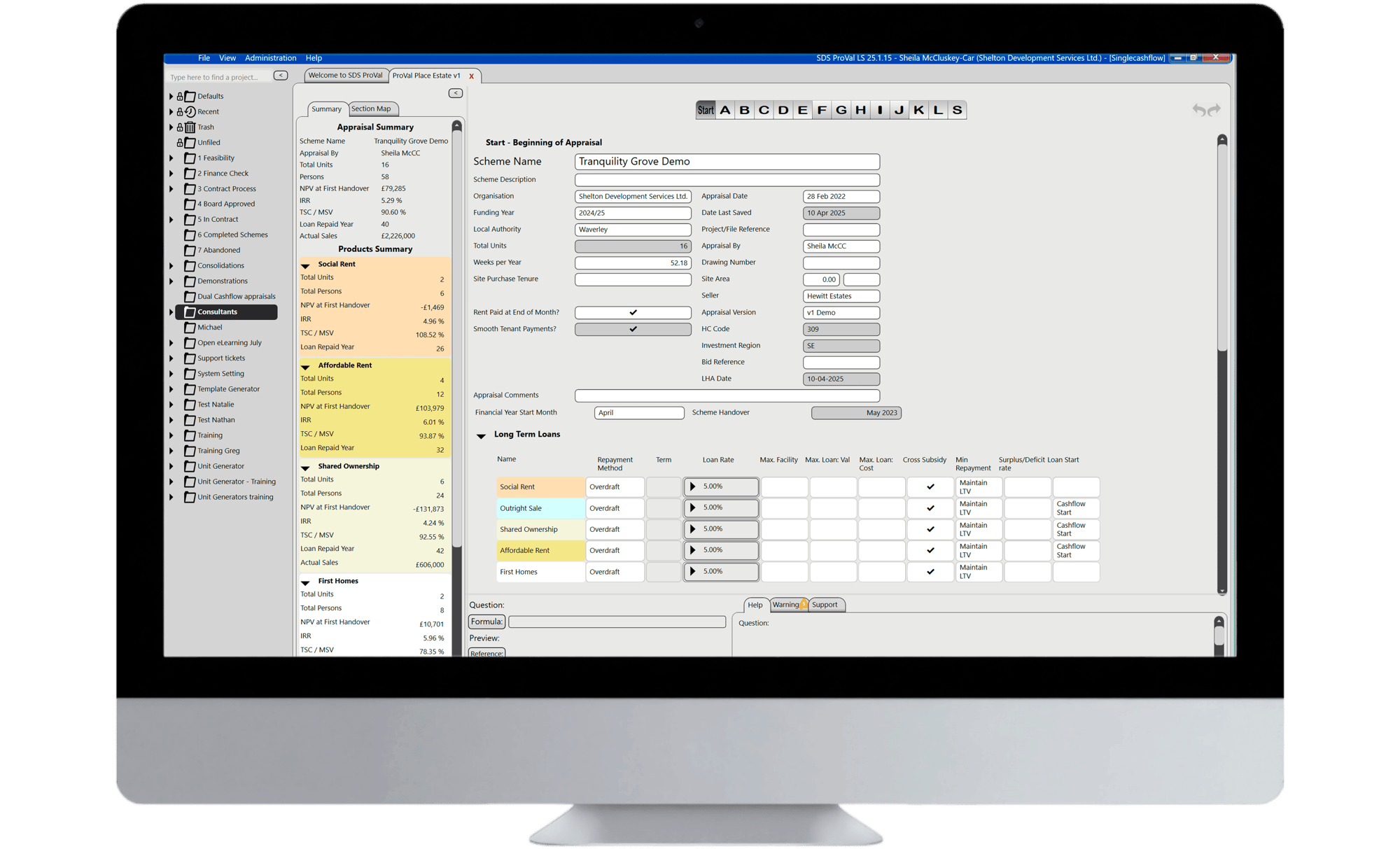

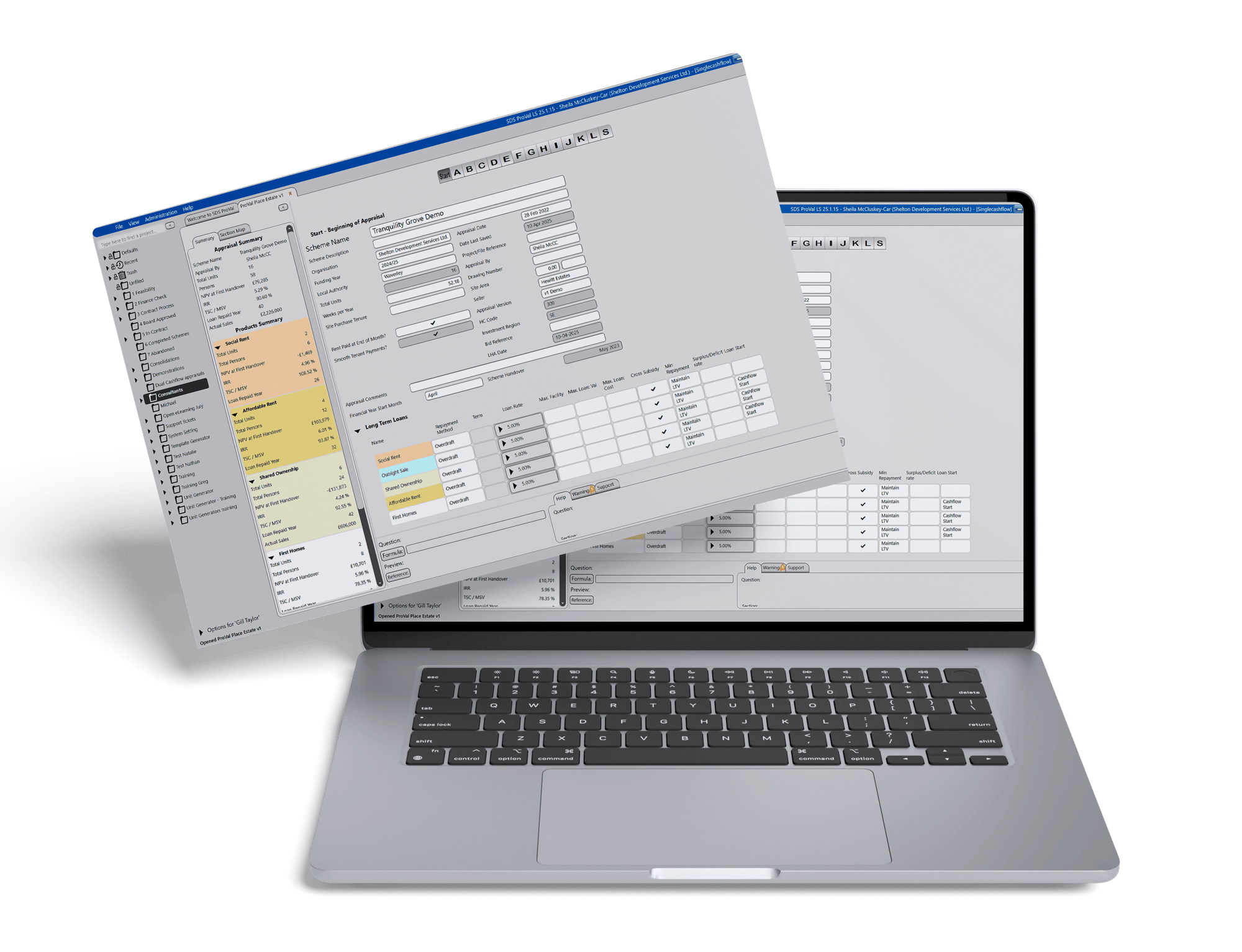

In the social housing sector, developers face numerous challenges, including tight budgets, regulatory compliance, and the need for precise financial forecasting. These factors can lead to significant risks, such as financial shortfalls, project delays, and non-compliance with viability guidelines. ProVal addresses these issues by providing a robust solution that enhances decision-making and risk management.

ProVal is specifically designed to tackle the complexities of financial viability in social housing. By offering tools to calculate and forecast critical financial metrics like Net Present Value (NPV) and Internal Rate of Return (IRR), ProVal enables developers to assess the long-term financial health of their projects. This foresight helps in identifying potential financial risks early, allowing for strategic adjustments that can prevent costly setbacks.

By consolidating data on a single, user-friendly platform, ProVal enhances visibility and control over financial information. This centralized approach not only simplifies data management but also supports more accurate and timely decision-making, ultimately reducing the risk of financial missteps and ensuring the success of social housing projects.

Get the results of your development appraisal and view the overall cost of every scheme.

Create mixed tenure appraisals for schemes of any size and dwelling type.

Conduct sensitivity analysis for every appraisal using default scenarios.

Produce reports automatically and eliminate time-consuming admin and double data entry.

View all your development appraisals in one place and get quick-access previews of each scheme.

Enhanced Risk Management

Tools to calculate and forecast key financial metrics like NPV and IRR, allowing developers to identify and mitigate potential financial risks early in the project lifecycle.

Regulatory Compliance

Ensure that financial appraisals meet viability compliance guidelines, reducing the risk of regulatory issues and ensuring adherence to industry standards.

Time & Resrouce Efficiency

By automating administrative tasks, ProVal saves time and frees up resources, allowing teams to focus on strategic planning and execution rather than manual data entry.

Robust Auditable Results

ProVal produces reliable and auditable financial reports ith ease, ensuring transaprency and accountability in financial decision-making processes.

Centralised Data Management

The platform consolidates all financial data in one easy-to-use interface, enhancing visbility and control, and supporting more accurate and timely decision-making.

Expert-Driven Design

Developed by social housing experts, ProVal is tailored to the specific needs of the affordable homes sector, ensuring that every feature is relevant and beneficial to social housing professionals.

"We use ProVal and Sequel for appraisals and project management, and the level of detail they provide allows us to see a true picture of our future development plans."

![]()

"From a finance perspective, our success has been the ability to double the number of projects we support without increasing staff resources."

![]()

"At CPC Project Services, we’ve found SDS ProVal to be an invaluable tool in delivering robust and transparent financial appraisals for our clients. The system’s flexibility and user-friendly interface allow us to model a wide range of development scenarios with confidence. SDS has consistently provided excellent support, helping us maximise the system’s potential and improve the quality and efficiency of our work."

Visualise cash flow forecasts for up to 100 years, ensuring comprehensive planning and sustainability.

Assign costs with precision based on tenure type, floor area, unit, bedrooms, and occupancy, tailoring financial strategies to specific project needs.

Access a clear breakdown of costs for each development type, facilitating informed decision-making.

Optimise scheme mix with reports on subsidy, outturn viability, and residual land value per unit, enhancing project profitability.

ProVal’s powerful appraisal tool is designed to streamline financial modeling, allowing housing professionals to build complex financial appraisals effortlessly. With the ability to include multiple tenure types in a single appraisal, users can eliminate the need for separate evaluations, saving valuable time. The tool also facilitates in-depth income drivers analysis, helping identify key financial factors that impact a scheme's viability to support strategic financial planning.

Efficiency is further enhanced throught quick dwellings input feature, allowing users to drag and drop properties from their library for faster appraisals. ProVal is built for scalability, enabling the appraisal of projects of any size or complexity in a single step, while its mixed tenure support allows for the incorporation of unlimited tenure types within one financial model, ensuring flexibility and comprehensive analysis. Additionally, individual viability results are available instantly, providing precise financial assessments for each dwelling type.

ProVal’s sensitivity analysis tool offers fast, accurate financial viability testing, empowering housing professionals to assess risks and optimize decision-making, providing detailed documentation of financial viability assessments for compliance and audits, ensuring transparency and accountability.

Save and reuse default scenarios for quick sensitivity testing, streamlining the analysis process.

Speed up sensitivity testing with automated calculations, enhancing decision-making efficiency.

Instantly generate detailed sensitivity reports from your data, providing actionable insights.

Store all sensitivity test data for future reference, ensuring continuity and informed planning.

By generating reports directly from your appraisal and financial data, the tool reduces manual effort and streamlines the reporting process. Users can create custom reports to meet specific project requirements, ensuring relevance and precision in their financial assessments.

With flexible export options, reports can be easily shared in Excel, Word, or PDF formats, enhancing collaboration and accessibility. Additionally, ProVal provides comprehensive database insights, allowing users to run reports on any stored data, offering a holistic view of project performance.

Keep all financial appraisals structured within an easy-to-navigate hierarchy, simplifying project management.

Gain instant insights with a tailored summary view of project results, supporting quick and informed decision-making.

ProVal is more than just a financial tool; it's a catalyst for positive change within your organization and the communities you serve. Here's how it can make a difference:

By providing accurate financial insights and projections, ProVal enables your organization to make informed decisions that lead to the successful development of affordable housing projects, directly benefiting the communities you serve.

With its robust forecasting and cost allocation capabilities, ProVal ensures that your organization can manage its financial resources effectively, maximizing the impact of every dollar spent on housing initiatives.

Fill in the form and speak with a member of our team.